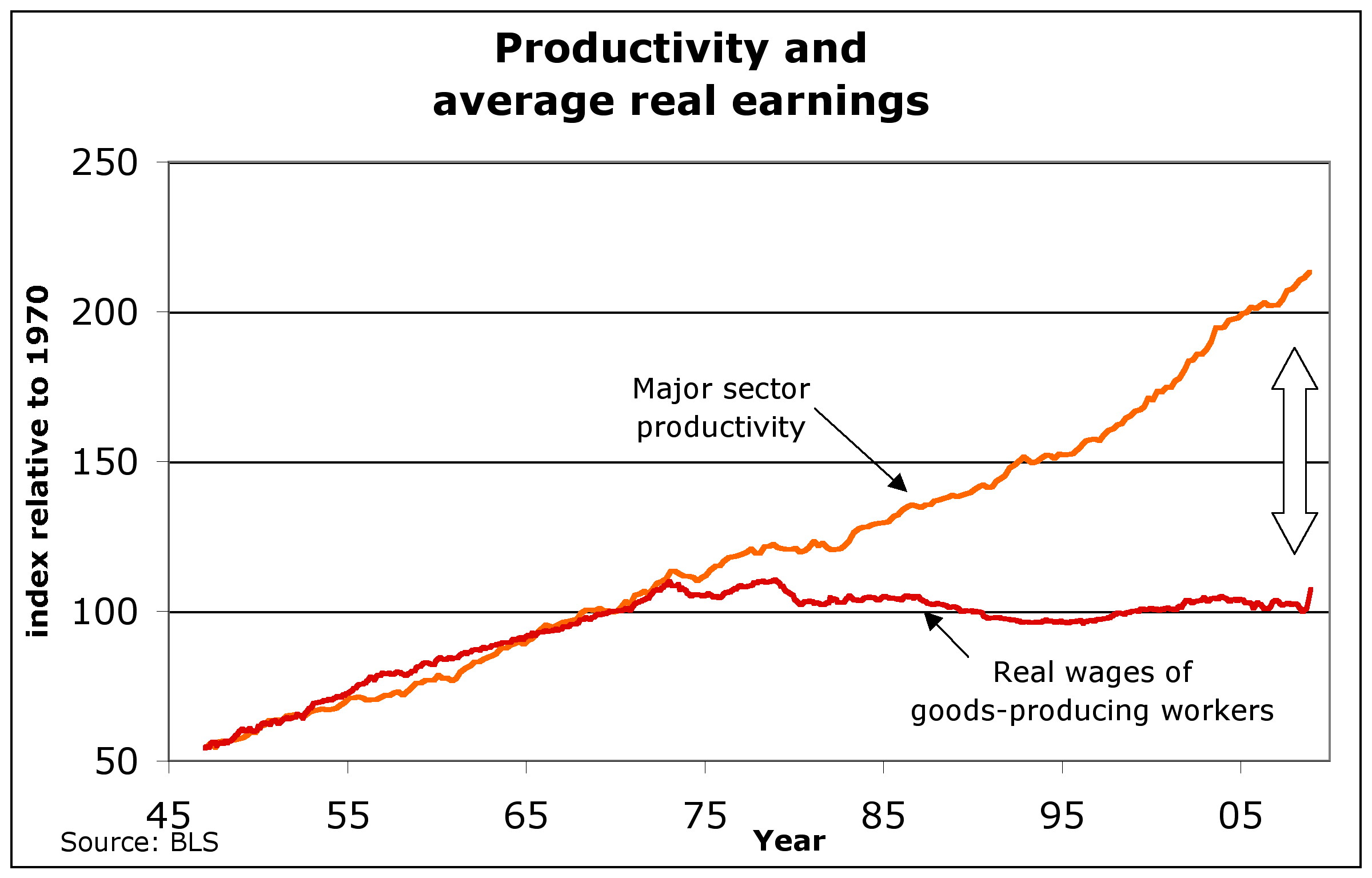

Discussions about stagnation of real wages are a thorny issue in many discussions online. I think that stagnation is typical of all Western countries, and among many graphs I found this one most instructive as it correlates productivity and real wages. The gap that is rising from the early seventies is discussed by fauceir terms.

Though this graph is from Wikipedia, unfortunately the original source (BLS) is unknown.

Usually wages are correlated with productivity, at least it works that way in free market capitalism. If there is a workforce on the free labor market that shows higher productivity, firms would compete to hire it. As higher productivity translates into higher profits firms can offer more salary, and that way wages become adjusted to workforce productivity. If this is not the case as shown in the picture, two reasons come into mind.

- There is no real increase in productivity.

- There is no real free market

Hypothesis 1: No real increase in productivity

There are difficulties to define productivity nationwide. According to Wikipedia it is easily determined for a single firm.

Productivity is a ratio of production output to what is required to produce it (inputs of capital, labor, land, energy, materials, etc.). The measure of productivity is defined as a total output per one unit of a total input.

But defining productivity of a whole nation is not trivial. (1) OECD defines productivity as work load per GDP. (2) The graphic depicts productivity restricted to major sector productivity. Both methods have their drawbacks.

The OECD method estimated productivity too height as GDP includes unproductive, even destructive money transfers. Usually in a healthy free market society GDP well correlates with overall production output, and also typically of a healthy free market society, there is only as much work force employed as necessary. Under such circumstances the ratio of GDP and employed workforce offers a good measure of a nations productivity. On the contrary an unhealthy market, one full of parasites, will give a distorted impression of productivity calculated by the OECD method.

The major sector productivity also estimates a nation’s average productivity too high. Although the real productivity in major sector firms may have been increased that increase may be eaten up by other sectors, parasitic ones in particular.

Conclusively, a nation’s average productivity can be estimated as a sum of independent units only if the units are acting really independently as typical of a free market. In a highly regulated markets as in all Western countries the whole nation has to be considered as a single unit. The output of such a unit is by contrast to blunt GDP the output of production minus unproductive output which include taxes, subsidies, social transfer, and lobbying costs. There unproductive outputs have to be added at the input side of the productivity ratio. To give the economic analogy of productivity of a single firm. Such a company may only sum up the income generated by selling the product as real output. If the company also improves working condition, this is input not output, but a nation’s GDP includes both.

Given the real calculations of a nations productivity as discussed above, I doubt there is any increase in productivity throughout the Western countries. I’d rather think that the average productivity is as flat or even declining as wages are.

Hypothesis 2: No free market

Admittedly, there is a remaining free labor market in all Western countries (at least the workers are free to choose a better position – employers are not so free any more to fire and hire a better worker), so by the free market mechanism as discussed above, wages should rise with productivity. Why did not?

To explain this we have to distinguish two types of productivity, the overall productivity and the workforce productivity. Of course only workforce productivity is immediately mirrored in wages given a free labor market. If a firm cannot expect a higher output by hiring a better worker it wouldn’t offer a better salary. However sure enough, if the worker is more qualified to operate a machine with better output he or she will be lured by the firm anyway. Thus if not immediately, through intermediate steps of more productive equipment and education, free market competition will translate into better wages. What however if the market is highly regulated?

And the market is highly regulated indeed.

- If competitors are not allowed to buy new machines or to launch production of new products due to market regulations they won’t hire workers to do the production. Example: Most of the iPhone production is in China. It would be easy for any other entrepreneur to sell a similar gadget for a better price, and I’m convinced still would be able to pay newly hired Apple workers better wages. But this is unfeasible as government protects Apple’s production by several copyright and patent laws.

- If an entrepreneur wants to launch production he or she might be deterred by subsidies or long term contracts granted to competitor. Example: the US automobile industry received such subsidies as well as Boeing and Airbus making it impossible for newcomers to enter the market.

Conclusively, though the labor market remained at least partially free, other market regulation stopped workers opportunities to negotiate.

Summary

As hypothesized at the beginning of this article the stagnation of real wages in the US and other Western countries is due to governmental market regulations.

- Governments by inflating parasitic industries and institutions eat up most of the increase in productivity still generated by some major sectors, so nothing is left over for worker’s wages.

- Governments prevent free market competition.

That is, instead of ensuring fairness in free market competition governments became participants in that competition themselves. By that measure they evolved back into feudalistic entrepreneurs (as medieval kingdoms) which is why we encounter all the problems typical of feudalism (including the monetary crisis) now.

Conclusively though governments insist that their market regulation are for the benefit of workers, they effectively cause the opposite, which will be even more obvious if raising income inequality is considered.

This work by Paul Netman is licensed under a Creative Commons Attribution-Share Alike 3.0 United States License.

Fauceir theory is developed and © by Mato Nagel and available at www.fauceir.org.